Estate Planning Attorney Fundamentals Explained

Estate Planning Attorney Fundamentals Explained

Blog Article

Not known Factual Statements About Estate Planning Attorney

Table of Contents10 Easy Facts About Estate Planning Attorney ShownEstate Planning Attorney - An OverviewA Biased View of Estate Planning AttorneyEstate Planning Attorney Fundamentals Explained

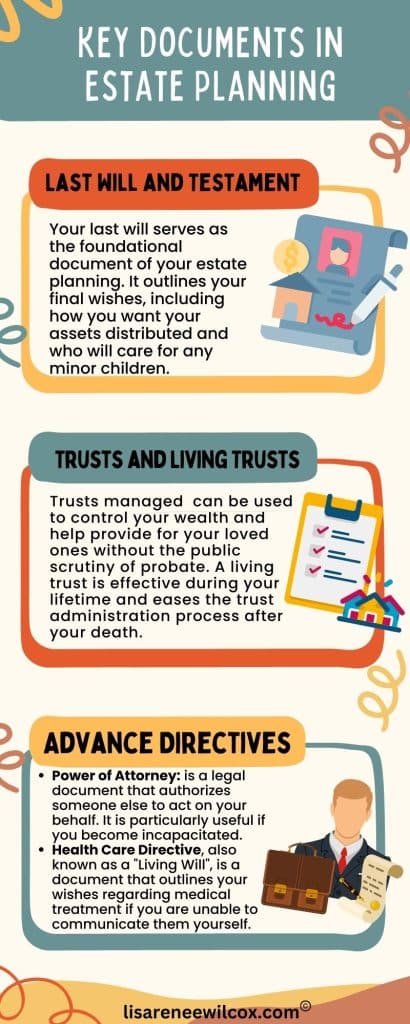

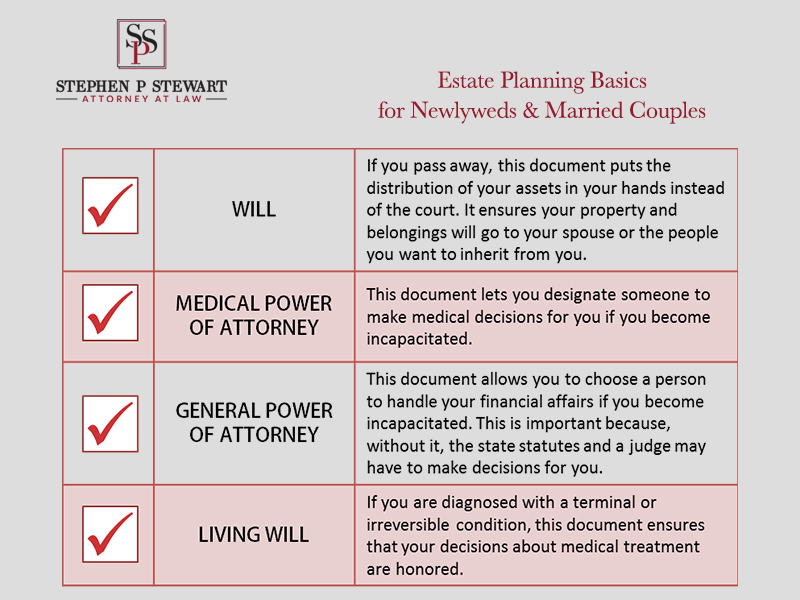

Estate preparation is an activity plan you can make use of to identify what occurs to your properties and responsibilities while you live and after you die. A will, on the other hand, is a legal file that details exactly how assets are distributed, that looks after youngsters and family pets, and any kind of various other desires after you pass away.

Claims that are declined by the executor can be taken to court where a probate judge will certainly have the final say as to whether or not the case is valid.

The Only Guide for Estate Planning Attorney

After the supply of the estate has been taken, the worth of properties calculated, and taxes and financial debt settled, the administrator will after that look for permission from the court to distribute whatever is left of the estate to the recipients. Any type of estate taxes that are pending will certainly come due within nine months of the date of fatality.

Each private locations their possessions in the trust fund and names someone other than their spouse as the recipient., to support grandchildrens' education and learning.

6 Easy Facts About Estate Planning Attorney Described

This method involves cold the worth of a possession at its value on the date of transfer. As necessary, the amount of potential funding gain at fatality is likewise iced up, allowing the estate coordinator to estimate their prospective tax obligation obligation upon death and far better prepare for the repayment of earnings taxes.

If sufficient insurance coverage earnings are available and the policies are correctly structured, any earnings tax on the considered dispositions of possessions adhering to the death of a person can be paid without turning to the sale of assets. Proceeds from life insurance policy that are obtained by the recipients upon the fatality of the insured are usually revenue tax-free.

Other charges connected with estate preparation consist of the preparation of a will, which can be as reduced as a couple of hundred bucks if you make use of one of the best online will certainly makers. There are certain papers you'll require as part of the estate planning procedure - Estate Planning Attorney. A few of the most common ones consist of wills, powers of lawyer (POAs), guardianship classifications, and living wills.

There is a myth that estate preparation is only for high-net-worth people. But that's not real. Estate planning is a tool that everybody can make use of. Estate preparing makes it less complicated for individuals to determine their desires before and after they die. In contrast to what the majority of people believe, it expands beyond what to do with possessions and liabilities.

Top Guidelines Of Estate Planning Attorney

You need to begin intending for your estate as soon as you have any kind of quantifiable property base. It's a recurring procedure: as life progresses, your estate plan need view website to shift to match your situations, in line with your brand-new goals.

Estate preparation is usually taken a tool for the rich. That isn't the situation. It can be a valuable way for you to take care of your assets and responsibilities prior to and after you pass away. Estate planning is also a wonderful way for you to set out plans for the care of your minor children check my site and pet dogs and to outline your yearn for your funeral and favorite charities.

Qualified applicants who pass the test will certainly be officially accredited in August. If you're eligible to rest for the test from a previous application, you might submit the short application.

Report this page